Tuesday, September 29, 2009

Monday, September 28, 2009

Hair Dyeing Fad Reflects Recession

Dyed hair is making a comeback. L'Oréal, the world's no.1 hair dye manufacturer, saw the sales of its hair color products surge some 30 percent in September compared to a year earlier. The sales of unusual dye including red, copper and metallic colors soared 47 percent. Experts make connections between the trend and the recession. A beauty specialist said people seek to escape reality in a recession, and dyed hair offers a kind of fantasy image. During the 1997-98 Asian financial crisis, dyed hair was also fashionable. More middle-aged people also dye their hair in an effort, experts say, to look younger and stand a better chance in the depressed job market.

It is a global phenomenon. The U.K. Telegraph called the phenomenon a "gold rush" and quoted celebrity hairdresser Andrew Barton as saying that many people are dyeing their hair blond to find an antidote to the depression. In the U.S., the term "hair dye index" was newly coined to show the link between the economy and dyeing hair. People's hair color becomes lighter as economy worsens. Hair dye is a counter-cyclical economic indicator which is roughly synonymous with an inferior good.

Sunday, September 27, 2009

Friday, September 25, 2009

Environmentalists Put Your Butt On The Line

Wednesday, September 23, 2009

Friday, September 18, 2009

Wednesday, September 16, 2009

Sunday, September 13, 2009

In Florida, Vestiges Of The Boom

in-florida-vestiges-of-the-boom.html: Personal Finance News from Yahoo! Finance

Florida is riddled with symbols of a building bust of unprecedented proportions. The half finished condominium projects throughout South Florida speak to the crazed speculation that fueled the development. The chips are now falling as the FDIC came calling on Friday and took over Corus bank of Chicago, a significant accelerant to the raging fire of construction. The fear is real that this is the beginning of a second wave of failures, this time in commercial properties. When the second shoe drops, will the government have the resources to contain the virus? Click on the link above to read more about this impending problem.

Florida is riddled with symbols of a building bust of unprecedented proportions. The half finished condominium projects throughout South Florida speak to the crazed speculation that fueled the development. The chips are now falling as the FDIC came calling on Friday and took over Corus bank of Chicago, a significant accelerant to the raging fire of construction. The fear is real that this is the beginning of a second wave of failures, this time in commercial properties. When the second shoe drops, will the government have the resources to contain the virus? Click on the link above to read more about this impending problem.

Friday, September 11, 2009

Thursday, September 10, 2009

More Americans Poor, Fewer Insured: Census Bureau

Median household incomes fell by in 2008 by 3.6 percent, to $50,303, the U.S. Census Bureau reports. The poverty rate rose to 13.2 percent, up by 0.7. Some 39.8 million people were classed among the poor last year, up by 2.6 million. The ranks of Americans without health insurance grew to 46.3 million, from 45.7 million -- a small enough increase to leave the percentage unchanged at 15.4 percent. Unpack the rest of the numbers in the Census Bureau's annual report on income, poverty and health insurance, including the news that 31 percent of the population fell into poverty for at least two months at some point between 2004 and 2007.

Wednesday, September 9, 2009

Consumer Borrowing Falls By Biggest Amount On Record

That giant snapping sound must have been your wallets closing. Americans slashed their borrowing in July by the largest amount on record, according to new numbers from the Federal Reserve. People pulled back on debt at a yearly pace of 10.4 percent, and that's after a 7.4 percent annualized drop in June. All told, Americans borrowed $21.6 billion less in July than they had in June, the biggest one-month drop since records began in 1943. Not even Cash for Clunkers could stop the rapid draining of credit. Demand for non-revolving credit used to finance cars, vacations, education and other things fell by $15.4 billion, also a record decline. That 11.7 percent pace was on top of an 8 percent annualized decline in June. This economic crisis has been described as a crisis caused by too much leveraging (or borrowing) followed a painfully rapid deleveraging (in which debtors either pay off what they owe or creditors give up collecting). It's also a crisis of over consumption followed by a painfully steep decline in consumer demand. In today's numbers from the Fed, those twin factors meet. Total consumer credit now stands at $2.47 trillion.

Tuesday, September 8, 2009

Sunday, September 6, 2009

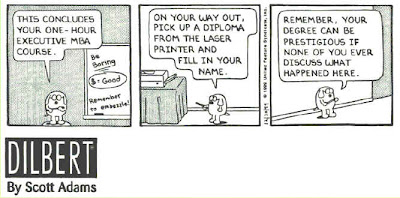

Why College Costs Rise Even During A Recession

It's an inexplicable phenomenon, the price of college increases every year regardless of the economy's health. If it's any consolation, this year's increase will be the smallest in memory. There are some interesting traditions and standards in the academic field that keep colleges from being as efficient as they can be. Likewise, there are services that most institutions offer that add extensively to the price tag. While Harvard and Yale will always be subscribed to and state universities have done a good job in keeping school affordable, the mid-tier university is at a crossroads. Click on the link above to discover the predicament and the age old systems that are now being questioned.

Friday, September 4, 2009

Thursday, September 3, 2009

Tuesday, September 1, 2009

The Economics Of Fairy Tales

Familiar fairy tales often have solid economic messages in their story lines. Not many people realize the allegoric connections with the Wizard of Oz but most of your bedtime memories from childhood were laced with basic fundamental concepts that would serve you well. Click on the link above to reconnect with your youth and find out how informed you really were.

Subscribe to:

Comments (Atom)